Freelancers often undercharge without realising. Use this simple formula to calculate your true hourly freelance rate and make sure your pricing actually works for you.

Summary: Knowing your minimum charge-out rate helps you price your work with confidence. By calculating your required income, work weeks, billable hours, and utilisation rate, you can set sustainable rates that cover your expenses and avoid burnout.

Figuring out what to charge as a freelancer can feel overwhelming, but breaking it down into a few key numbers makes it much simpler.

Here’s what you need to know:

- Your annual expenses

- Work weeks per year

- Work hours per week

- Utilisation rate

The homework: calculate these numbers

Your annual expenses

This is the minimum amount you need to cover your living costs and business expenses each year. It’s your baseline income goal. If you don’t already know this, MoneySmart has a free online calculator or you can take your best guess.

Let’s say it’s $50,000.

Pro tip: Track your actual expenses for a month or two to make sure your budget reflects reality. Many freelancers underestimate hidden costs like software subscriptions and irregular expenses 🧐

Work weeks per year

Freelancers don’t work 52 weeks a year — there are holidays, sick days, and slow periods.

A reasonable estimate might be 46 work weeks per year.

Pro tip: Look back at the past year as a guide to estimating time off. How many public holidays were there? How many sick days did you need? Mental health days? Did you take any vacations? 🏝️

Work hours per week

Decide how many hours you want or expect to work each week.

Say you work an average of 6 hours every weekday, that’s 30 hours per week.

Pro tip: Be realistic about your ideal work-life balance. Overestimating your available hours can lead to burnout and underpricing ⚖️

Utilisation rate

Not every hour you work is billable (paid for by your clients) — there’s time spent on emails, marketing, and admin.

If 75% of your time is billable, then for every 30 hour week, only 22.5 hours are paid.

Pro tip: Track your work hours for a few weeks coding what’s billable vs non-billable to figure out your utilisation rate. There can be seasonal fluctuations so for example, if your utilisation rate varies between 70-80%, you might average this to 75% 📈

The payoff: calculate your rate

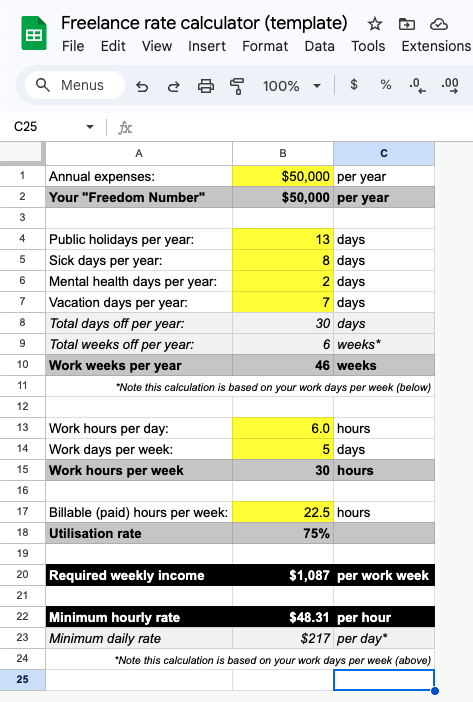

Freelance rate calculator (template)

Once you have these numbers, you can calculate what you must charge to stay afloat.

Required Weekly Income

= Annual Expenses ÷ Work Weeks Per Year

(eg. $50,000 ÷ 46 = $1,087 per week)

Billable Hours Per Week

= Work Hours Per Week × Utilisation Rate

(eg. 30 × 0.75 = 22.5 billable hours)

Minimum Hourly Rate

= Required Weekly Income ÷ Billable Hours Per Week

(eg. $1,087 ÷ 22.5 = $48.30 per hour)

Need a template to work this out? Here you go! It’s free 😉

Note: This calculator is for general informational purposes only and does not constitute financial advice. Individual circumstances vary, and you should seek professional financial guidance before making pricing or business decisions.

Setting your freelance charge-out rate

Your minimum hourly rate represents the rate you would need to cover your expenses (ie. break even), but if you want to save, invest, or grow your business, you’ll need to charge more — unless these things were already factored into your annual expense calculation.

Pro tip: Pricing isn’t just about covering costs — it’s also about positioning. If your rate feels low for your industry, consider adding value through specialised services or improving efficiency to increase profitability without overworking 💪

Why This Matters

Too many freelancers undercharge because they don’t know these numbers. By taking the time to do this calculation, you’ll price your work with confidence, avoid burnout, and build a sustainable freelance business.

Want help getting your freelance operations in order? Let’s chat!

This content is for general informational purposes only and does not constitute financial advice. Every freelancer’s situation is unique, and you should seek professional financial guidance before making any decisions about your pricing or business finances.